Options trading part 8: Inverted term structure | Backwardation

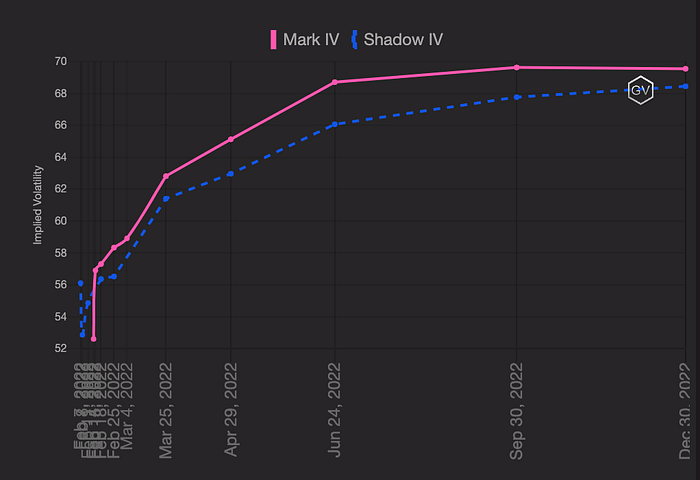

In an “inverted vol term structure,” the ATM implied volatility term structure is higher for option contacts with shorter maturities and lower for options with longer maturities.

When the ATM implied volatility term structure is “inverted,” options with shorter maturities have higher implied volatilities than options with longer maturities.

This “inverted term structure” is also known as “backwardation.”

That is the opposite of “normal” or “contango”

The opposite of contango, in which ATM implied volatility is lower for shorter-term option contracts (shorter maturities) and greater for longer-dated option contracts (longer maturities).

As covered in the previous article

Video introduction about contango vs. backwardation (as explained in the previous article)

When does the ATM implied vol term structure invert?

Inverted implied vol term structures can occur when there is high demand for shorter-dated options (as investors seek to hedge against near-term market uncertainty) and low demand for longer-dated options.

So, higher prices for shorter-dated options and lower prices for longer-dated options, result in an inverted term structure.

An inverted implied vol term structure can be a sign of market stress or anxiety.

An inverted vol term structure or “backwardation” may form if investors anticipate a high probability of a near-term event that will cause volatility to spike.

Such occurrences may include a central bank statement, a big political event, or a recent market shock.

The ATM implied vol term structure could flip from “contango” into “backwardation”.

Suppose market participants buy shorter-dated options to hedge against near-term market uncertainty and volatility. In that case, it could signify that they are expecting or anticipating some negative market event.

To protect themselves against the projected volatility surge, they will be ready to pay a higher premium for option contracts that expire close before or after the event.

That information can help make trading decisions and to gauge market sentiment.

ATM implied vol term structure refers to the relationship between the implied volatility of options with different strike prices (“At the money” option contracts) and expiration dates.

The ATM implied vol term structure is said to be in “backwardation” when “At the money” option contracts with shorter expiration dates have higher implied volatilities than ATM options with longer expiration dates.

Inverted term structure — rush for gamma exposure

Remember from the previous articles

Gamma, often known as the option’s “curvature risk,” is our second risk consideration for trading options and delta hedging with options trading.

“Gamma Γ” is the change in “delta” of an option contract for every dollar change in the underlying (i.e., spot). Gamma is the “delta Δ” sensitivity relative to a change in the underlying market.

So gamma is a measure of the rate of change of an option’s delta in response to a change in the underlying asset’s price/market.

As the underlying moves, the delta moves because of Gamma.

So, when the ATM implied vol term structure is in backwardation

There is an increased demand for option contracts with a high rate of change in their delta in response to changes in the underlying asset’s price.

The option contracts for that are those with a “gamma” exposure.

Why is there an increased demand for option contracts with the highest gamma?

Because the options greek that gives you exposure to the “realized volatility” is “gamma.”

Which option contracts have the highest gamma?

The option contract maturity that contains the most gamma is the short-dated part of the curve.

So the option contracts that don’t have much time left to expire.

When the ATM implied vol term structure is in backwardation, there is another reason for increased demand for options that have a high gamma.

For instance, traders, market makers, dealers, and liquidity providers are “short gamma” by “short-selling” option contracts.

To cover their positions, they must either repurchase the option contracts that were “short-selling” or buy additional short-dated option contracts with higher gamma exposure.

So they may need to buy short-dated option contracts with higher gamma exposure in the short-dated curve to neutralize their gamma exposure or remain within the risk parameter of their hedge or quant fund demands.

For instance, a prop trader may have excessive vega exposure in terms of risk parameters. He will get a warning that his vega exposure is too high, and he must return to his allowed risk parameter.

What happens when the ATM implied vol term structure flips from contango to backwardation?

When the ATM implied vol term structure transforms from

contango (an upwardly sloping curve)→ to a backwardation (a downwardly sloping curve)

That shift in shape suggests that the front of the ATM implied vol term structure (the portion of the curve corresponding to short-term option contracts, so the front is trading at a premium or more expensive.

When the ATM implied vol term structure changes from contango (an upwardly sloping curve) to backwardation (a downwardly sloping curve), this change in shape indicates that the front of the ATM implied vol term structure is trading at a premium or more expensive.

That is because market participants buy options contracts with short-term maturities while longer-term option maturities increase, although not to the same level.

The longer-term option contract provides more “vega” exposure than gamma exposure, where most “gamma” exposure comes from the shorter end of the ATM implied vol term structure and “vega” from the longer end of the curve.

As the curve changes from contango to backwardation, the front end of the ATM implied vol term structure has the potential to move much further than the longer end of the curve.

The same happens if the curve flips from Contango to backwardation. The shorter end of the curve has the potential to move much further.

When the shape of the ATM implied vol term structure moves from contango to backwardation, the front of the ATM term structure is trading much more expensive.

So market participants buy short-dated options, while the longer-dated option contracts also become more expensive (but not to the same degree), which results in a greater “vega” exposure than “gamma: exposure.

So again, the short end of the ATM term structure contains more “gamma,” whereas the long end has more “vega” exposure.

That indicates that the front end of the ATM implied vol term structure is more likely to see a substantial shift when the curve switches from contango to backwardation.

The ATM implied volatility structure refers to the relationship between implied volatility and the option’s time to expiry (maturity). That relationship represents a curve, with volatility rising from lower to higher maturities.

However, the form of this curve might change based on the underlying market.

For instance, front-end ATM options may trade with implied volatilities ranging from 66 to 120, but longer-dated options may only have volatilities ranging from 80 to 105.

That means that the timing of your trade and the date the option contract expires are very important to your possible profit or loss.

If you are “long vega”, you want the implied curve to steepen (greater volatility at longer maturities), but a flatter curve will favor those who are “short vega.”

An option contract “vega” is a measure of the impact of changes in the underlying on the option contract price.

All else being equal, as volatility increases, the value of an option will increase as well (if you are long the option) or decrease (if you are short the option contract)

Therefore, vega can be considered the “risk” or “volatility” of an option contract.

We covered “Vega” in one of the previous articles

When trading options contracts, it’s important to remember that your trade could be affected not only by changes in the underlying market price but also by changes in volatility.

That emphasizes the importance of “vega” in options trading. By taking into account the “vega” of your options position, you can better gauge the potential risk and reward of the trade.

What does it mean if the ATM implied vol term structure is flat?

For instance, if the current shape of the ATM implied vol term structure (i.e., the relationship between ATM implied volatility and maturity) is relatively flat. That is generally seen as a transitional state, occurring when the market is going from lower volatility to higher volatility (or vice versa).

When the term structure is in a transitional state like this, it can be tricky to predict where the market is heading.

However, if we look at the recent history of the term structure, we can see that it is likely heading back from a stressed state.

That suggests that the market is currently transitioning, and it is difficult to say exactly where it will go next.

If you are interested in trading bitcoin/crypto futures contracts

I recommend FTX for spot, futures, options & MOVE contracts trading

If you don’t have an FTX account, use my link to get a 10% discount instead of the normal 5% discount from others.

Another good exchange is ByBit for spot, futures & options trading

https://www.bybit.com/register?affiliate_id=6776&group_id=0&group_type=1

For Binance, receive a 10% discount on futures trading instead of 0% from other referral links

For trading BTC, ETH, SOL options, and futures, I recommend Deribit. Receive a 10% discount on fees:

Final words

Leave a clap for the algorithm on medium if you enjoyed it.

Feel free to leave a comment if you enjoyed it.

I highly recommend you create a medium account and follow me. Turn on email notifications.

Part 9 of options trading will be released soon

More medium articles?

If you are looking for more medium articles like this written by me, you can find them here.

Twitter: https://twitter.com/RNR_0